Hello Guys !!

Welcome Back after a Long time on the Blog, Wasn't Able to Post on Blog since Long due to Work Load and Work From Home Due to Pandemic. Too many Things to handle and It's a Tough Job !!

We Witnessed a Market Crash and a fear among the Traders and Investors across the Globe!

In Overall Situations.. We have seen a Smart Play by Smart Investors and Big Hands across all Markets including Indices, Commodities and Currencies. I have been updating continuously to our Paid Group Members during all this time and Many times said One thing in most of my analysis of situation.

It's a Big Game by Smart Minds of the World. The Global Economy is currently dominated by three kinds of Mafia, Weapons, Oil and Pharma are the 3 segments who control all Global Economies. Current Situation was a Kind of War, A Different kind of War to Control smaller Economies.

Many guys were expecting a Very Bad markets and doomed economies... But what is happening is beyond understanding of retail players. Smart Money Fooled all Small, retail Players.. Even some Fund Managers, Hedge Funds, Analysts also went wrong in this situation.

Let'e See What is Happening Across Different Markets..

Today I am Posting Analysis of Few Major Globally Tracked Stock Market Indices. All the Views Posted here are Positional Here and One Can not Expect a Quick Intraday move in All those Recommendations. The Levels Given are Important levels, you may consider them for your Trading decision. One Can Trade Underlying Stocks with our Index Views... Be Careful, All the Levels are Applicable for Next Few Months Time and We Don't Expect a Straight Line Move as per our Expectations. It will be a Wild Moving Market. Trade Smaller Trades with CFD's ... Avoid Futures. Follow Risk Management !!

-----------------------------------------------------------------------------------------

Starting With US Markets and the Most Watched Stock Market Index :

DOW JONES INDUSTRIAL AVERAGE (DOW30 or US30)

This is a Monthly Chart,

What I see in this Chart, is Very Clear Picture...The Index Never turned bearish.

Yes, You Heard it the Right way... Just Have a look at the Chart,

I have Marked 2 Trend Lines on the Chart.

First Trend Line is in Light Gray Color starting from 1999-2000.. Drawn from Top Connecting all Highs and Extended to current Levels.

Second Trend Line is Drawn in Dotted Black Color, starting from 2010 to Till date.

The First Trend Line acts as a Support Now and We can See it has given Support to price at the Lows.

The Second Trend Line was Broken and price closed below the Trend line for some time but managed to Pierce the Line again and Moved above the Trend Line, respecting the Trend.

We can See Few Support Lines also. The Support at 18216 was a Strong Resistance in 2015 and Rejected Price Multiple times in 2015 & 2016. The Same Resistance is acting as a Support Now. Current Low is Exactly on the same Support Line.

The Support at Higher level 23350 is Broken to fall and again pierced to reverse above the Support. Current Monthly Candle is Comfortably Trading above the Support line.

A 100 Period Simple Moving Average is also Placed, Which works Perfectly fine as a Support Near Longer Term Trend Line.

So We have Seen Multiple Supports Near 18000-19000 zone which was respected and Price Recovered very Sharply to again gain Strength and Move in a Rising Uptrend.

Let's See a Clear Picture on Weekly Chart ..

This is the Chart of Weekly Time Frame. The Picture may be More clear now. The Lines are same as per the Monthly Chart, No Changes done.

Only Thing I have Changed is the Moving Average, Here I have added a 200 Period Simple Moving Average.

Adjusted some Support Lines to fine Tune them to get perfect Levels. Now Anyone with a Very Basic Knowledge of Charts can also say.. It's still a Bull Market.

We May Still See some Volatility, which I am not Ignoring. But Levels are Very Clear now and the Trades can be taken accordingly..

Let's See More Details ..

This is a 4 Hour Chart of the same Index. Here I can sense a Bullish Formation of Cup & Handle, having neckline at 24740 approx. A Breakout above the neckline will ensure we get a strong rally soon. I will be expecting a retest of All time High if the breakout succeeds and No More Bad News on Global Scale emerge.

Recommendation Here is :

BUY DOW JONES

Buy Above 24740

Stoploss : 23350

Take Profits : 26820 - 29260

Obviously This will not be a straight line journey, We may Expect many ups and downs in the process. So trade Carefully and Avoid Futures, Better Buy CFD's to avoid Expiry day worries.

Moving On to Next Index ...

-----------------------------------------------------------------------------------------

Here is the World's Most Tracked Index

S&P 500

Let's See the Charts ..

This is a Monthly Chart and as you all Can See, it's a Clean uptrend... Tried to Fail in Last 2 months due to the COVID-19 Pandemic but supported by old Strong Level of 2140-2150. The Index then Moved up and Pierced the Rising Trend Line again to Trade in an uptrend. The Additional Support was provided by the 50 Period Simple Moving Average. Last Month the Index faced Resistance to cross important resistance level of 2940, But managed to Cross this Month and it will Prove to be an important level in the upcoming period. Monthly Closing above 2940 will prove good for the Markets Globally and The S&P500 will move towards the All Time High again.

Let's See a Detailed view in Lower Time Frame:

This is a Daily Time Frame Chart, The Breakout of Bullish Cup&Handle is already done and sustaining above the Neckline. We will see a Strong upmove towards 3140 and 3399 levels in coming months for sure. Only condition for this upmove is, the S&P500 should not break 2820 level soon. I am Personally seeing a Rally towards New All Time High Very Soon. Again the Same is will happen only if there is no Bad News on Global Scale on a Larger Scale. I am Actually seeing many Positive News and Developments ahead which includes a Positive development of Vaccine for the COVID-19.

Recommendation Here is :

BUY S&P500

Buy level : 2940-2950

Stoploss : 2820

Take Profits : 3140 - 3399

Trade Carefully.

-----------------------------------------------------------------------------------------

Next Index on the Radar is :

NASDAQ COMPOSITE

Starting with a Chart ..

This is a Monthly Chart of NASDAQ COMPOSITE Index, The Index is consistently in uptrend since 2008 crash and it is clearly visible on the chart. The Rising Trendline is respected continuously and is Supported by a 50 Period Simple Moving Average. The uptrend is still intact during this Volatility. There was a Sharp Correction but supported around by the Trend Line and the Moving Average. There was a Strong Resistance after the Fall around 8180 levels. The Level is Broken and the Index is again moving higher. Nearing the All time High again. We Might See the New All time High and a Move Towards 11800 in coming months.

Recommendation here is :

BUY NASDAQ COMPOSITE

Buy Level : 9200-9400

Stoploss : 8180

Take Profits : 9820 - 11800

This is not the NASDAQ 100 that is tracked in Media. so Be careful with levels and do not mix up. trade carefully

-----------------------------------------------------------------------------------------

Next Index on Our Radar Will be

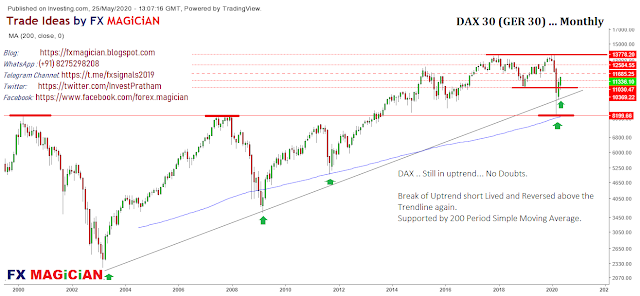

DAX 30 (GERMANY)

Starting with a Chart :

The Trend is clearly a Rising Trend in this Index, Nothing to worry yet. All is Well and under control of Smart Money. I will be Little Quick in Analysis as it is Almost the Same in Many Indices. This Index was Struggling at all time High since a long time and finally got a chance to correct sharply with the Entry of the #chinesevirus. Once the Sharp Fall occurred, Most of the Shorts in System might have been liquidated as they got a chance to book profits after a Long time. After the Sharp move down, Smart Money took Control and The Index Reversed Equally Strong to recover major losses on the Index. In the Process, the Index crossed Strong Resistance around 10370 and 11330. Now Strong Resistance is at 11685 Only and above that We have Few Smaller Resistances till the Previous All time High is touched. We Need to Cross 11685 Level with Strength and sustain above that level. I am sure it will be done.. Reason?

Let's see the Daily Chart:

Here is the reason, I am expecting the Important Resistance will be cleared.. The Chart is Similar to Other Global Major Indices. a Strong Bullish Cup & Handle Structure is formed and the Breakout is also seen above the Neckline of the formation. This formation really works with a great success ratio if it is formed at the right place. The Neckline is placed around 11340 and it is hardly 350 points away from the major resistance at 11680 level. Above the Neckline the Index will be Stronger unless and Untill we face a major bad News.

Nothing to worry till it trades above 10370 Levels.

Recommendation here in this Index is :

DAX30

Buy Level : 11340 - 11400

Stoploss : 10370

Take Profits : 11680 - 12580 - 13777

Trade Carefully

-----------------------------------------------------------------------------------------

Next Index On Our Radar Will be:

NIKKEI 225 (JAPAN)

Let's Start with a Chart ..

This is One of the Finest Formation seen here, Perfect Rounding Bottom type Structure. Index is Moving Perfectly in this structure and I Expect the Index to Perform Exceptionally well in coming months. We can see a Rising Channel within this structure. The Rising Channel is respecting all the levels in ups and downs. Recently Tried to break the Channel but the Rounding bottom structure supported alongwith a 100 Period Simple Moving Average and the Index Managed to recover and Move again in the Rising Channel.

A Major Resistance at 18320 is Crossed comfortably and trading above the level. Now Only 1 Important resistance ahead at 20880. If this is also crossed, we will see a Move Towards Recent High of 24160+

I am Expecting the Index to Move towards 29170 levels in coming months or years. This journey will not be smooth but you may focus on this Index for major moves and the constituent Stocks for Investment Purpose in longer Term. The Index has been always a Under performer, Now it's time to change the equations.

I am Expecting the Index to Move towards 29170 levels in coming months or years. This journey will not be smooth but you may focus on this Index for major moves and the constituent Stocks for Investment Purpose in longer Term. The Index has been always a Under performer, Now it's time to change the equations.

We may see Daily Chart here ..

The Daily Chart suggest the Level of 20880 as an important level for a Breakout and we will be Seeing a breakout above 20880 level. The Consolidation and Range Contraction at this levels is suggesting a Possibility of a breakout in this case.

Recommendation here is :

NIKKEI 225

Buy Levels : 20600 - 20500

Stoploss : 19800

Take Profits : 22222 - 23333 - 24166

Trade Carefully !!

-----------------------------------------------------------------------------------------

Next Index to Watch here is

HANGSENG 50 (HK50)

Let's See the Chart...

The Chart is a Monthly Chart with a Rising Trend Line, Supported by a 200 Period simple Moving Average. We can see a Support Level Working at 21250. it is Working as a confluence Point due to all 3, Trend Line, Moving Average and the Support Line Crossing each other at the same level. It has worked as a Strong Support so far. The Index is still in a Small Correction, Once it Crosses 24000 levels, we can expect Fire Works here. So For Any Possible trade Entry..Either wait for a Dip towards the Support or a Move Above the Resistance. Hang Seng was trading around 22950 When stock was downloaded. Today it closed at 23377, small distance away from crossing the resistance of 24000 level. Above 24000 We will see a move towards 28900 and most Probably a New all time High.

Recommendation here is

HANG SENG

Buy Level : 24020 (Buy on Crossing Resistance)

Stoploss : 23000

Take Profit : 28900

Or

Buy Level : 22000 (Buy on Dips)

Stoploss : 21250

Take Profits : 24000 - 28900

The Path will be Really bumpy ahead. Be Careful in taking leverage Positions.

-----------------------------------------------------------------------------------------

ALL The Indices Discussed here are Major Indices tracked in the World. I was Planning to Cover More, But Then Time Limits and Restriction on Free Posting Applies. I have to keep Few Things For Paid Members as Well.

ALL the Reading are based on charts posted here. Follow The Charts for Exits also. We May Not See Market Moving as Per Our Readings, Market may become Highly volatile in case of any adverse news or events following up the COVID-19 Pandemic. The Economies across the World are affected due to this small Virus. So Always be Safe and Trade safe. Will Keep Posting Trades On Our FREE WHATSAPP GROUPS and TELEGRAM CHANNEL.

-----------------------------------------------------------------------------------------

Will Be Starting the Free Group Trade Postings From 1st June 2020. This is a First Look For the Same.

We have many Free WhatsAPP Groups and a Telegram Channel for the Same.

Join the Groups or the Channel and Follow the Analysis and Trades...

The Links are as given Below :

WHATSAPP Free Group No. 07 .... CLICK HERE

No Need to Join Both Groups... be in Anyone, All are same !!

TELEGRAM Channel ... CLICK HERE

-----------------------------------------------------------------------------------------

Declaration:

The Analyst ATUL SHINDE is a Technical Analyst and Expert in Global Markets analysis. He is a Certified Investment Adviser having experience of 13+ years in International Markets as a Service Provider and a Fund Manager. The Views are Based on Chart Analysis and The Analyst Reserves the RIGHT to be WRONG !!

Trade with Proper Risk Management and Position Sizing.. Any Losses or Profits are your own.. do not come blaming us here !! You Know the Risk of trading Forex and Equities !!

-----------------------------------------------------------------------------------------

#Dow30 #US30 #Nasdaq #sp500 #indices #US #DAX30 #Ger30 #HK50 #Nikkei225 #Japan #Germany #Hongkong #forex #Forextrading #trading #tips #fxsignals